Understanding Crypto Indices: The Building Blocks of Digital Asset Investment

As cryptocurrency markets continue to mature, the role of indices has become increasingly crucial for institutional investors and financial advisors navigating this complex landscape. These benchmarks serve as essential tools for measuring market performance and creating investment products, much like their traditional finance counterparts.

The Architecture of Crypto Indices

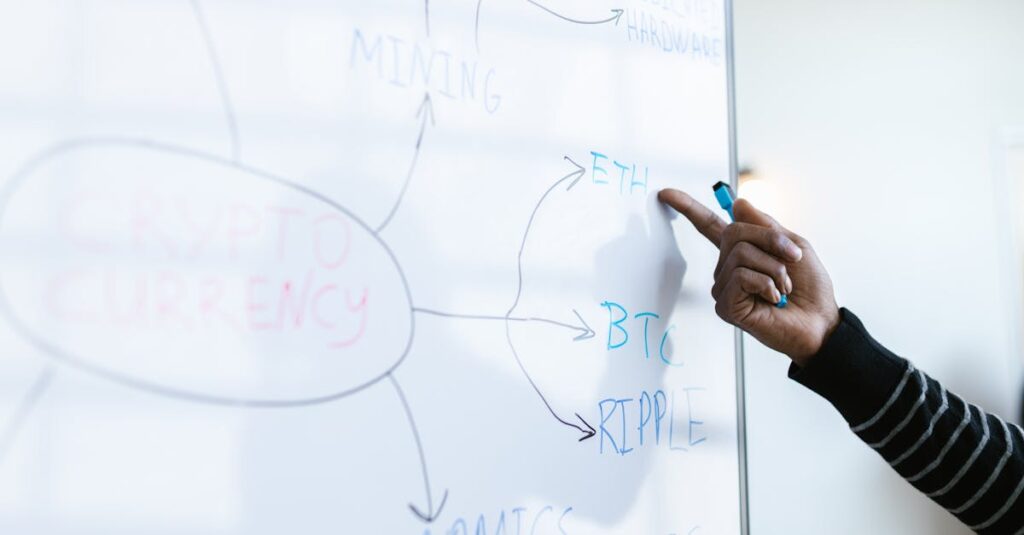

The foundation of any reliable crypto index lies in its methodological framework, which encompasses three critical components: asset selection, weighting mechanisms, and rebalancing protocols. Unlike traditional market indices that have evolved over decades, crypto indices face unique challenges in maintaining transparency and reliability in a rapidly evolving digital asset ecosystem.

Asset selection criteria have emerged as a particularly crucial element in crypto index design. While traditional indices like the S&P 500 have well-established inclusion standards based on market capitalization and trading history, crypto indices must navigate additional complexities such as technical viability, security considerations, and regulatory compliance. These factors have become especially relevant following several high-profile cryptocurrency failures in recent years.

Index weighting methodologies in the crypto space have developed distinct characteristics from their traditional counterparts. While market capitalization remains a common approach, many crypto indices have implemented sophisticated modifications to account for factors such as circulating supply, trading volume, and network security. This evolution reflects the unique nature of digital assets and their underlying blockchain technologies.

Key Metrics and Performance Indicators

Financial advisors and institutional investors analyzing crypto indices must understand several unique metrics that differ from traditional market measures. These include network hash rates, active wallet addresses, and on-chain transaction volumes – indicators that have no direct equivalents in conventional financial markets.

Network Health Metrics: Modern crypto indices increasingly incorporate measures of network robustness and decentralization. These technical indicators help assess the fundamental strength of digital assets beyond pure price action, providing a more comprehensive view of asset quality.

Historical Context: Back in 2017, when crypto indices first gained prominence, they primarily focused on price and market capitalization. The industry has since developed more sophisticated evaluation methods, incorporating technological and network-specific metrics that better reflect the unique characteristics of digital assets.

Implications for Financial Advisors

The evolution of crypto indices has significant implications for financial advisors incorporating digital assets into client portfolios. These benchmarks now serve as crucial tools for portfolio construction, risk assessment, and performance measurement in the crypto space.

Index-based investment products have become increasingly popular, offering more regulated and transparent exposure to digital assets. These vehicles typically provide better liquidity and risk management compared to direct cryptocurrency holdings, making them particularly relevant for traditional investment portfolios.

Professional investors must understand that crypto indices often exhibit different characteristics from traditional market benchmarks. Factors such as 24/7 trading, global accessibility, and technological dependencies create unique dynamics that affect index behavior and performance attribution.

Future Outlook

The cryptocurrency indexing landscape continues to evolve, with several trends shaping its development. Enhanced transparency requirements, improved methodologies for handling network forks and airdrops, and greater integration of decentralized finance (DeFi) metrics are emerging as key areas of focus.

As institutional adoption of digital assets grows, crypto indices are likely to become increasingly sophisticated, potentially incorporating new metrics related to environmental impact, governance quality, and regulatory compliance. These developments will be crucial for maintaining the relevance and reliability of crypto indices as benchmarking tools.

The maturation of crypto indices represents a significant step forward in the institutionalization of digital asset markets. As these benchmarks continue to evolve, they will play an increasingly important role in portfolio management, product development, and market analysis, helping to bridge the gap between traditional finance and the crypto ecosystem.

Source: Crypto for Advisors: Crypto Indices Explained